Xinyi Glass Achieves Record High for Annual Results of 2018

Revenue Up 8.7% to HK$16.01 Billion

Net Profit Up 5.6% to HK$4.24 Billion

* * *

Strategically Pushes Forward Capacity Expansion

Strives to Optimize Global Expansion Strategy

Highlights

(Hong Kong, 25 February 2019) – Xinyi Glass Holdings Limited (“Xinyi Glass” or the “Group”) (stock code: 00868.hk), a leading integrated automobile glass, energy-saving architectural glass and high-quality float glass manufacturer, has today announced its annual results for the year ended 31 December 2018 (“FY2018”). During the year under review, its overall revenue, gross profit and net profit recorded historical highs, driven by overall sales volume growth in float glass, automobile glass and energy saving architectural glass and effective cost control to stabilize the production costs. The Group also continued to further pursue its strategy of introducing more diversified and differentiated product portfolio, as well as expanding high value-added product portfolio, and has strategically advanced its global expansion strategy in order to fully implement a prudent and pragmatic business strategy.

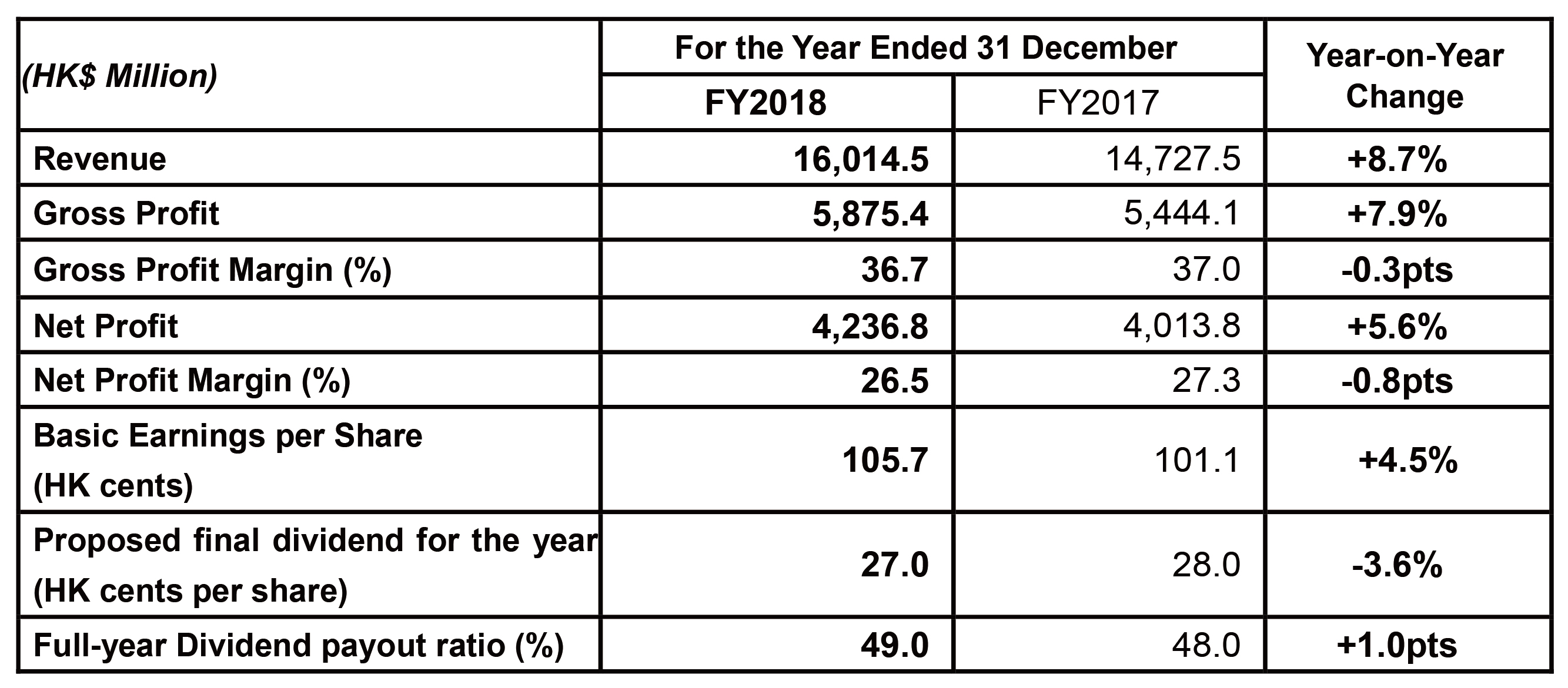

During FY2018, thanks to the strong performance of the float glass, automobile glass and architectural glass businesses, the Group’s revenue increased by 8.7% to HK$16,014.5 million. Gross profit increased by 7.9% to HK$5,875.4 million and gross profit margin was 36.7%. The Group’s net profit for the year increased by 5.6% to HK$4,236.8 million, and net profit margin reaching was 26.5%. Basic earnings per share were 105.7 HK cents.

Xinyi Glass is in a sound financial position. As of 31 December 2018, the Group had cash on hand of HK$4,692.3 million. (31 December 2017: HK$3,057.1 million). The Board of Directors has proposed the payment of a final dividend of HK [27.0] cents per share. Together with an interim dividend of HK25.0 cents already paid, the total dividend for the year amounts to HK [52.0] cents, representing a dividend payout ratio of [49.0]%.

Dr. LEE Yin Yee, B.B.S., Chairman of Xinyi Glass, said, “Continuing the strong performance in the first half of 2018, the Group has reported satisfactory business results for the year, with several new historical highs achieved. This demonstrates Xinyi Glass’ leadership in the global glass industry. Xinyi Glass has a business model that supports sustainable growth and a highly vertically integrated glass manufacturing system. The Group is the market leader in three glass business segments, namely high quality float glass, automobile glass and energy savingarchitectural glass. Leveraging our close ties with customers and our technological advantages, we have implemented a strategy of widening our high value-added product portfolio, and have optimized our global strategy in a bid to capture growing market demand and bring satisfactory returns to our shareholders.”

Business Review

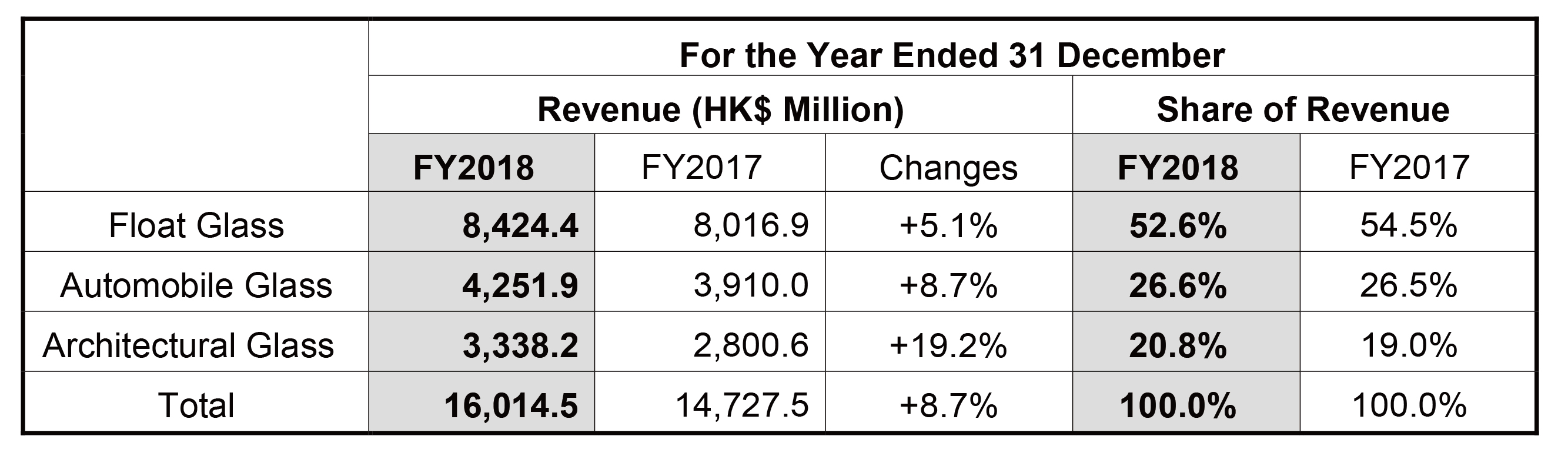

The Group’s revenue by business division is as follows:

High Quality Float Glass – Actively Developing Specialty and High Quality Float Glass, Implementing Strategic Capacity Expansion Plan

Benefitting from the implementation of more stringent government policies concerning the restriction on production capacity in the PRC, together with the Group’s active expansion of its differentiated product portfolio and effective cost control measures has enabled the float glass business to achieve an increase in revenue of 5.1% to HK$8,424.4 million. Gross profit has risen by 7.4% to HK$2,731.4 million and gross profit margin increased to 32.4%. Being the largest high-quality float glass manufacturer in Asia, the Group has continued to implement its capacity expansion plan in FY2018. Given that the float glass production line at Phase One of the Malacca plant in Malaysia has been operational since the second quarter of 2017, and two high-quality float glass production lines at Phase Two of the Malaysian plant has commenced operation in the second and fourth quarter of 2018, with daily melting capacity of 800 tonnes and 1,200 tonnes respectively, the Group will be able to maintain its cost advantage and enhance profitability over the long term.

Automobile Glass – Implementing Flexible and Active Marketing Strategies to Achieve Satisfactory Business Performance

The automobile glass business has performed satisfactorily. Revenue increased by 8.7% year-on-year to HK$4,251.9 million. Gross profit has remained flat at HK$1,865.9 million, with gross profit margin at 43.9%. The drop in gross profit margin was mainly due to rising production costs and additional import tariff imposed by the US. Being the largest exporter of automobile glass in the aftermarket in the PRC, the Group has adopted flexible and proactive marketing strategies and at the same time has expanded its product variety and production capacity to drive sustainable growth of its automobile glass business.

Energy Saving Architectural Glass – Steady Growth in Demand Furthers Business Growth

During the year under review, revenue derived from architectural glass surged by 19.2% year-on-year to HK$3,338.2 million. Gross profit jumped by 20.0% to HK$1,278.1 million, with gross profit margin at 38.3%. The robust growth of the business segment was mainly due to the government’s vigorous promotion of energy-saving construction materials, which drove demand for energy-saving low-emission coated architectural glass in the PRC construction market. Consequently, prospects for architectural glass are expected to remain favorable.

Geographic Market Analysis

The Greater China region remained as the Group’s largest geographical market, recording a rise in revenue of 6.2% to HK$11,437.9 million, and accounting for 71.4% of total revenue. Revenue from overseas markets continued to grow, rising by 15.8% to HK$4,576.6 million.

Prospects

The float glass industry will soon enter a period of consolidation. As a number of production lines in the industry will enter cold repairing, the price of float glass can be better managed. In recent years, the Group has been actively expanding overseas and optimizing its strategic presence. Its plant in Malaysia has helped to mitigate the fallout from political tensions caused by the trade dispute between China and the US, allowing the Group better serve its ASEAN-based, Indian and Korean customers. Shorter transport distance is also favorable for its customers in Asia as well as customers outside Asia. With the gradual implementation and commencement of its new production lines, the Group expects to boost aggregate daily melting capacity by 50% by the end of 2020, which will be 50% above the aggregate capacity achieved in 2017, thus enable it to cater for strong demand from China as well as around the world. Meanwhile, the Group will step up efforts to expand its high value-added product portfolio to raise the gross profit margin of the Group’s products. Contributions from ultra-clear, ultra-thick and ultra-thin differentiated products are expected to account for around 40% of the revenue of the Group’s float glass business in 2019.

The Group is also confident about the performance of the automobile glass business in the future. It will continue to expand production capacity in the PRC in order to enlarge its market share, so as to meet demand from more overseas customers as well as maintain the sales volume of its automobile glass.

As for architectural glass, the Group will focus on developing energy-saving and high value-added single insulating, double insulating (triple layers) and laminated insulating (triple layers) glass products, including high performance and custom-made single silver, double silver and triple silver coating Low-E glass in order to meet the expected growth in demand.

Dr. LEE concluded, “We have been actively promoting business internationalization and the optimization of our global presence in recent years to seize potential opportunities from the international market. Economy of scale and quality product mix are solid competitive advantages that we enjoy as an industry leader. Looking ahead, we have utmost confidence in the prospects for the industry, and will execute sound, pragmatic and aggressive business strategies to overcome challenges and capture opportunities as we strive to provide quality glass products to the industry and customers, and satisfactory returns to our shareholders.”